The crypto market is having a tough time and Voyager Digital Ltd has not been able to avoid getting dragged in.

Back in November 2021, the total crypto market was worth around $3tn.

However, after a series of events including the war in Ukraine, rising interest rates and the collapse of Terra (LUNA), it's now worth less than a third of that.

Global stock markets are also way down, but not by the same amount. The main reason is that crypto is still a risky asset class and there's not so much 'cheap' money around.

At times of uncertainty, many investors stay away from risk, which directly impacts crypto.

This is Nothing New

Cryptocurrency prices have always been volatile.

It's a largely unregulated market which means that there's plenty of risk, but also huge profit available for those brave, patient and smart enough to take advantage.

Look at the history...

In December 2017, Bitcoin surged to its all-time high just under $20,000. But by February 2018, it had crashed to just under $7,000 and to around $3,000 by December 2018.

The 'FUD' (fear, uncertainty and doubt) at the time was in overdrive! Lots of inexperienced investors sold in a panic and looked on in horror as Bitcoin hit $63,000 in April 2021.

The price more than halved again (under $30,000) by July 2021 then hit another all-time high of just under $67,000 in November 2021.

As I write this, the Bitcoin price is a little under $20,000.

According to various 'experts' Bitcoin has died 385 times... and yet here we are.

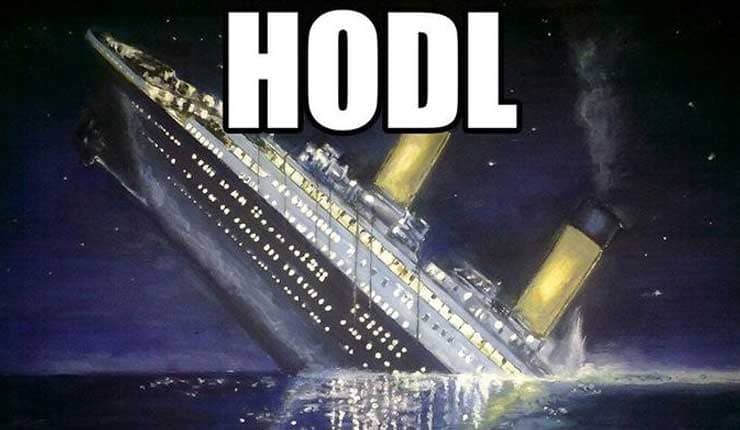

HODL

You don't need to be a mathematical genius to work out that the 2017/18 crash from $20k to $3k was much more extreme than the recent drop from $67k to $20k.

It could go lower yet, but I don't see any need for panic.

Back in 2018 I decided to HODL or 'hold on for dear life' and it paid off massively.

I happily sold Bitcoin at the new 2021 highs for a massive profit.

Therefore, I'll do exactly the same thing... nothing. If it takes until 2025 before Bitcoin reaches more new highs, that's fine. I'm not in any rush.

Voyager Digital

Voyager's situation is much more perilous than it was during my last update in April.

On 13th May 2022 they quoted in an email that:

Did you know that not all coins are created equal?

Some people are learning that painful truth now. It’s important to do your own research, ensure you manage your personal risk, and keep yourself informed throughout.

Did you know that Voyager has zero exposure to algorithmic stablecoins?

Some stablecoins get their value from collateralized crypto assets. We choose to work with stablecoins, like USDC, that have real 1:1 cash and cash equivalents backing them.

Then on 14th June 2022 they sent an email which incuded the following:

Voyager has zero customer asset exposure to Celsius. While we announced a partnership in 2019, through our ongoing due diligence and rigorous risk management process, we made a decision to start moving funds from Celsius earlier this year.

We have never engaged in DeFi lending activities, including algorithmic stablecoin staking and lending. We have zero exposure to derivative assets like stETH.

This last email was sent after Celsius suspended withdrawals.

Now... while Voyager Digital had no direct exposure to algorithmic stablecoins, they had lent around $646m worth of crypto to Three Arrows Capital (a crypto hedge fund).

Three Arrows Capital became insolvent after the collapse of Terra (LUNA) and its algorithmic stablecoin, UST. This led to Voyager issuing a default notice to Three Arrows Capital.

Survival Mode

Initially, Voyager reduced withdrawal limits to $10,000 per day. Their aim was to prevent mass withdrawals while they shored up the balance sheet.

They secured a $500m line of credit from quantitative trading firm Alameda Research, which was on top of the $200m already on Voyager's balance sheet.

However, it seems that this wasn't enough to stem the tide and all withdrawals were suspended on 1st July 2022.

Steve Ehrlich explained that, "This provides time to continue exploring strategic alternatives and preserve the value of the Voyager platform we have built together. We are in discussions with various parties and will provide additional information at the appropriate time."

Not good news at all, but Voyager has valuable assets in the form of regulatory approval in multiple markets. There's bound to be interest in a deal which includes access to that.

In addition, a court in the British Virgin Islands has ordered Three Arrows Capital to liquidate its assets to repay debts and financial obligations.

Whether it amounts to much is yet to be seen.

Stock and Token Values

Naturally, the stock price has taken an absolute hammering.

At the time of writing, it's down at $0.31 which is way below my average buy price of £5.84.

Should Voyager Digital survive and continue trading, that's going to look an absolute bargain. I'm tempted to average down further, but not aggressively as it's very risky.

The VGX token has also dropped significantly in value, but not by as much as I expected.

At the moment, it's at $0.26 which is still far above the $0.05 I originally bought at.

I can only assume that the token price has held up because any new owner (if Voyager Digital were to be sold) would continue with the VGX token.

Nothing to do here except HODL and hope that Steve Ehrlich's survival plan works.