YieldNodes was going so well... but this crypto market is tough.

I deposited around €30,000 (approximately £25,000) into my YieldNodes account. It ended up as a little more than that as the Bitcoin price rose slightly as I was transferring it across.

There's a 7 day holding period while servers are rented, so I received a return of €821 at the end of November 2021 which covered a few days.

From December 2021, my full balance went to work and I compounded 100% of my monthly profits. After six months of compounding, I withdrew my initial €30,131.

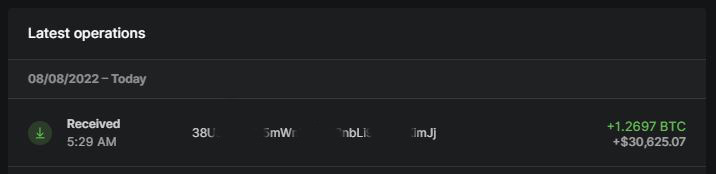

I'd originally deposited 0.570377 Bitcoin but I received 1.2697 Bitcoin back because the price had dropped since November. That was an unexpected bonus of 0.699323 Bitcoin!

I left the balance of €21,013 which was now completely risk-free!

Also, I reduced the compounding percentage to 50% which gave me a monthly income, while still growing my overall balance.

Here's my monthly progress:

| Opening Balance | Monthly Return | Monthly Profit | Withdrawals | Closing Balance | Banked Profit | |

|---|---|---|---|---|---|---|

| November 2021 | €30,131 | - | €821 | €0 | €30,952 | €0 |

| December 2021 | €30,952 | 7.5% | €2,319 | €0 | €33,271 | €0 |

| January 2022 | €33,271 | 8.0% | €2,661 | €0 | €35,932 | €0 |

| February 2022 | €35,932 | 8.3% | €2,982 | €0 | €38,914 | €0 |

| March 2022 | €38,914 | 7.4% | €2,880 | €0 | €41,794 | €0 |

| April 2022 | €41,794 | 8.3% | €3,468 | €0 | €45,262 | €0 |

| May 2022 | €45,262 | 6.5% | €2,942 | €0 | €48,204 | €0 |

| June 2022 | €48,204 | 6.1% | €2,940 | €30,131 | €21,013 | €0 |

| July 2022 | €21,013 | 9.2% | €1,933 | €966 | €21,980 | €966 |

| August 2022 | €21,980 | 6.1% | €1,341 | €670 | €22,651 | €1,636 |

| September 2022 | €22,651 | 5.3% | €1,200 | €600 | €23,251 | €2,236 |

What Happened to the Market?

As we all know, nothing in crypto is zero risk. If that were the case, I'd invest 100% of my net worth and never work another day of my life!

I wrote previously, "crypto is risky so don't deposit more than you could afford to lose if, for some reason, everything went wrong".

Central banks have taken action to combat global inflation and they do this by increasing interest rates. With the cheap money gone, riskier assets are not being bought up and selling pressure is reducing their value.

At some point, the market will reach the bottom. When it does, smart investors with cash will buy assets cheaply and make a fortune.

We've seen this happen a number of times in the housing market. Higher interest rates force more repossessions, property prices fall because there's more supply than demand, then those with cash buy up all the bargains.

What Happened to YieldNodes?

While there was plenty of cheap money around, the YieldNodes business model worked perfectly. They were able to sell all the masternoded coins and pay everyone out.

However, there are not nearly as many buyers in the crypto market right now and liquidity for smaller coins has dried up.

In addition, a couple of exchanges have frozen YieldNodes' assets. If you've ever had an issue with Binance, you'll know how long it takes them to fix it.

Rather than go into hiding or disappear with everyone's money, CEO Stefan Hoermann has addressed all the issues in a video interview.

He said that "we do not want to leave anyone with a loss" and that "no-one needs to fear that we are going anywhere".

Here's the full interview...

What Happens Now?

The plan is switch to 'YieldNodes Pro' which includes physical assets. This has always been in the works, it's just being pulled forward out of necessity.

While the team work on the switch, we will receive a 5% return quarterly. This is obviously less than the monthly returns that were regularly achieved, but still very good.

My savings account at Lloyds Bank only pays 0.4% annually!

The first 5% payout occurred at the end of December 2022. I received €1,562.07 though, of course, there's not a lot that I can do with it at the moment.

I could put some (or all) of my account balance up for sale at 40% of the total value, but that seems a bit drastic.

If the YieldNodes team can make the switch successfully, we'll all have the option to withdraw, continue earning or a bit of both.

Considering all the other crypto projects and companies that have hit the wall recently and left investors with nothing, this sounds much more hopeful.

Good luck to Stefan and his team.

I was seriously interested in getting involved with Yieldnodes especially since they reduced the initial investment amount and I’ve seen quite a few interviews over the past few weeks and Stefan seems genuine. What has put me off slightly is that the web page just has the most recent announcement and a login link, nothing else. When I sent an email to the support email address asking if new subscriptions are still available I got absolutely nothing back.

This is not the time to be putting money into YieldNodes. We need to wait for the restructuring to take place and see some stability, then decisions can be made.

Will the 5% quarterly return be a permanent feature after the switch (assuming it goes successfully)? Or, will the higher monthly returns be offered again at some point? Can you explain more about what ‘Yield Nodes Pro’ involves?

Hi Steve

I don’t know any more than what’s been shared in the video and on the website. It sounds like the 5% quarterly is just to tide us over while they switch, hopefully we get back to the higher returns. If not though, 5% quarterly would still be outstanding.

The YieldNodes Pro assets are listed as:

– 2 hubs in Germany and Malta

– A large photovoltaic power plant in Germany (11.5 MW)

– Several photovoltaic power plants in Italy and Germany (>2 MW)

– A large photovoltaic power plant in Iran (23 MW)

– An HTC plant in Germany connected to all patents (https://htcycle.ag/en/about-us_8)

– A music publisher and streaming provider in Germany

– The Mobolith project with which we can charge electric cars without a charging network and which also compensates for the disadvantages of the very volatile power supply from the sun and wind.

– Various residential, commercial and social properties, building plots and forests where we focus on sustainable construction and management.

5% quarterly is a good return, however I can get a similar return to that with Nexo – where my investment capital is insured and I can make daily withdrawals with zero fees. Without the higher monthly payouts, I am struggling to see the advantage of investing with Yield Nodes. The list of assets you posted looks interesting, but the long term plan for the company looks vague and far from reassuring.

In the video, Stefan explains why the immediate switch to YieldNodes Pro is necessary. If there are no buyers in the market, then the masternoding model doesn’t work. Market conditions are tough and more companies will go to the wall before it all blows over. There’s very little reassurance in the market at this time, no crypto company is without risk.

I imagine the plan looks vague because they’ve had to throw it together in a day. All we can do is give them time to manage the switch. If all goes well, we’ll have the choice of withdrawing our funds or continuing to earn at whatever rate it becomes. It’s not the news that anyone wanted, but it’s not necessarily game over.

OK, I’ll just wait and hope then. I look forward to reading your updates about this in future.

Any comment on recent developments with YieldNodes. No doubt you’ve got all your money out in time etc.

Hi Rich

I’ve updated the post with my thoughts. There’s no way I could have known to get my remaining €23,251 out, I knew as much as anyone else. If all works out though and I get 5% quarterly in the meantime, I’ll be perfectly happy. The crypto markets are rough right now.

Do you know how long Yield Nodes are intending to offer this service roughly?

Hi Steve

I haven’t asked that question. As long as it’s profitable, I can’t imagine they’d want to stop.

bonjour . pouvez vous m”expliquer commen faire apres voir deposer 500.00 euros ??

SVP je vous remercie

cordialement

Hi Adam

There’s nothing more to do except set your “Automatic Compounding” amount on the “Withdrawal” page. Mine is set to 100% for now, I’ll review it in 6-12 months.